Successful completion of the course may lead to a certificate from IIM, which holds high credibility and recognition in the corporate world.

A comprehensive course on financial risk management: concepts, tools, risk identification, measurement, analysis, mitigation, derivatives, credit, market & operational risk.

Courses at IIMs are typically taught by experienced and knowledgeable faculty members who have expertise in the field of finance and risk management.

The course often includes case studies and real-life examples to provide practical insights into financial risk management practices and challenges faced by businesses.

The Course curriculum aligns with current industry trends in financial risk, equipping participants with relevant skills for today's business.

Participants have the chance to interact with other professionals, creating a valuable network of peers and potential collaborators.

Graduates (10+2+3) or Diploma Holders from a recognized university (UGC / AICTE / DEC / AIU / state Government) in any discipline.

Aspirants with professional experience in any domain.

The IIM Financial Risk Management Course will cost INR 80,000/- + 18% GST. Easy EMI options are available.

Risk Managers

Financial Analysts

Auditors

Compliance Officers

Risk Consultants

Credit Analysts

Chief Risk Officers

Finance Managers

Portfolio Managers

Investment Bankers

Consultants and Advisors

Regulators and Policy Makers

Aspirants Seeking a Career in Finance Risk Management

Obtaining a Financial Risk Management certification from IIM Visakhapatnam offers a range of substantial benefits. It serves as a transformative step in your career, elevating you to the status of a strategic leader and good knowledge and skills to understand the effecting aspects of financial risk management that will provide a good ROI as career advancement, relevant skills, and tools like Excel and R, higher salary, networking opportunities, Enhanced Leadership Abilities, Job Security, Innovation and Digital Transformation and many more.

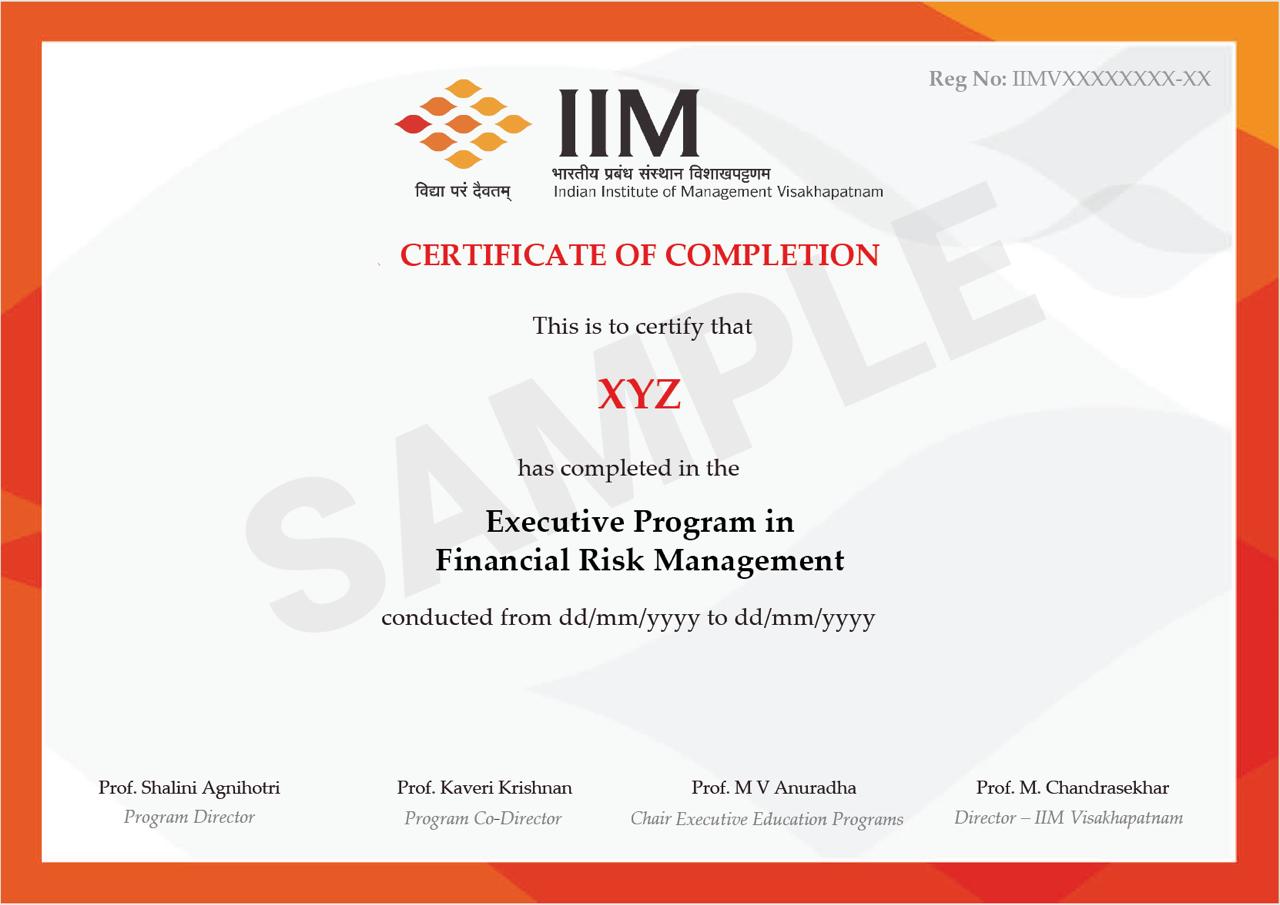

Upon successful completion of the Executive Certificate Program as Financial Risk Management, IIM Visakhapatnam Executive Education will grant a verified certificate to participants. To be eligible for the certificate, participants must meet the minimum attendance criteria and satisfactorily submit the final project.

Participants will be advised by professional counselors over the virtual mode

Profiles will be shortlisted in view of qualification standards and counselor comments on the profile.

Profile gets Approved or Rejected based on the shared information.

Only Approved profiles proceed further for enrollment process.

Indian Institute of Management Visakhapatnam (IIMV) belongs to the prestigious IIM family of business schools. It is a new generation IIM, set up by the Government of India in September 2015. At 26th place among the business schools pan-India in the National Institutional Ranking Framework 2024 of the Government of India, it is ahead of all new-generation IIMs established in 2015/2016.

Visakhapatnam is a picturesque port-city on the east coast of India. It is easily accessible by air, sea, rail, and road connections. It ranks among the cleanest cosmopolitan cities in the country. The city is a popular tourist destination with a beautiful beach on one side and a majestic mountain-range on the other. The vibrant city is well known for its heritage and hospitality; culture and cuisine; tradition and talent; trade and technology; innovation and industry; entrepreneurship and enterprise. Visakhapatnam is a base to several large, medium, and small companies (public and private) in the core sector, energy, financial services, infrastructure, IT, pharma, etc. The Eastern Naval Command of the Indian Navy is headquartered at Visakhapatnam. In short, it is one of the most preferred destinations in India to live, learn, yearn, and earn.